|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pet Insurance in Winnipeg: A Comprehensive Guide for Pet OwnersIn the bustling city of Winnipeg, where the Assiniboine and Red Rivers meet, an increasing number of pet owners are turning to pet insurance as a vital part of caring for their beloved companions. The concept of pet insurance, while relatively straightforward, is often accompanied by a myriad of questions and considerations that can be overwhelming, especially for new pet owners. This article seeks to demystify pet insurance in Winnipeg, offering insights and advice to help you make informed decisions that best suit your furry friend's needs. Why Consider Pet Insurance? For many, pets are more than just animals; they are family. This emotional bond underscores the importance of ensuring their health and well-being. Veterinary care, while essential, can be unexpectedly costly. From routine check-ups to unforeseen emergencies, the expenses can quickly add up, leaving many pet owners financially strained. Pet insurance serves as a financial safety net, offering peace of mind that, regardless of the situation, your pet can receive the care it needs without you having to worry about the cost. This is especially pertinent in a city like Winnipeg, where seasonal changes can sometimes bring unique health challenges for pets. Choosing the Right Policy The process of selecting a pet insurance policy involves careful consideration of various factors. Firstly, assess the specific needs of your pet. Different breeds may have predispositions to certain health issues; for example, larger breeds might be more prone to joint problems, while smaller breeds could face dental issues. Additionally, consider the age and overall health of your pet, as these can influence the type of coverage you require. When evaluating policies, pay attention to the details: what conditions are covered, are there any exclusions, what are the deductibles and reimbursement rates? These elements can vary significantly between providers, making it crucial to read the fine print. Winnipeg's Unique Considerations Winnipeg's climate can pose specific challenges for pets. Harsh winters, for instance, may lead to frostbite or hypothermia, while the hot summers might cause heatstroke or dehydration. A comprehensive pet insurance plan should ideally cover these seasonal risks, ensuring that you are prepared for any eventuality. Additionally, living in an urban area with diverse wildlife, there is always a risk of encounters with other animals, which could lead to injuries that require medical attention. Benefits Beyond Coverage Beyond the obvious financial benefits, having pet insurance can also positively impact the relationship between you and your pet. Knowing that you can provide the best possible care without the constant worry of cost can enhance the quality of life for both you and your pet. It encourages proactive health measures, allowing for regular check-ups and preventive care, which can lead to a longer, healthier life for your companion.

FAQs About Pet Insurance in WinnipegWhat does pet insurance typically cover? Most pet insurance policies cover accidents, illnesses, and emergency care. Some may also cover routine check-ups and vaccinations, but this varies by provider. Is pet insurance worth it for older pets? While premiums may be higher for older pets, insurance can still be beneficial due to the increased likelihood of health issues. It's important to compare policies to find the best fit for your pet's needs. How do I choose the best pet insurance provider in Winnipeg? Research various providers, compare their coverage options, read customer reviews, and consider recommendations from your veterinarian to make an informed decision. Are pre-existing conditions covered by pet insurance? Typically, pre-existing conditions are not covered by pet insurance. It's important to enroll your pet when they are young and healthy to maximize coverage benefits. https://www.reddit.com/r/Winnipeg/comments/rra90n/pet_insurance/

Worth every penny ($30/month each). The coverage is 80% coverage and $2,000 per incident. It pays for itself in annual dental work alone. Last ... https://winnipeghumanesociety.ca/adoptable-animals/pet-insurance/

We are a proud partner of Petsecure, a 100% Canadian owned and operated pet insurance company since 1989. https://www.fetchpet.com/canada/locations/winnipeg-pet-insurance

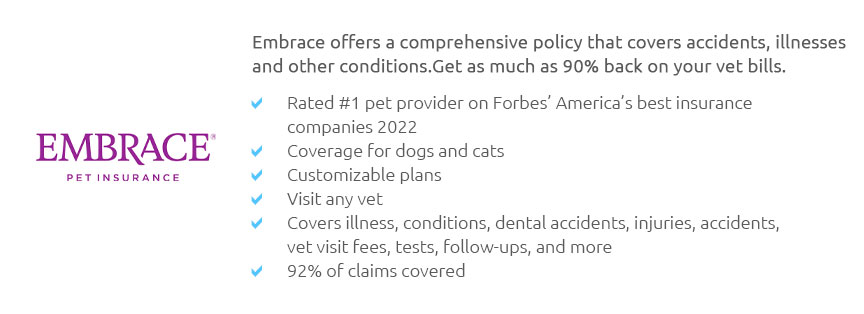

Fetch is the most comprehensive pet insurance in Canada, including Winnipeg and all of the US. We pay back up to 90% of unexpected vet bills when your pet ...

|